In the past two days, news about Intel’s actions that hurt the emotions of the Chinese people has been overwhelming, and domestic public opinion has been in a state of uproar.

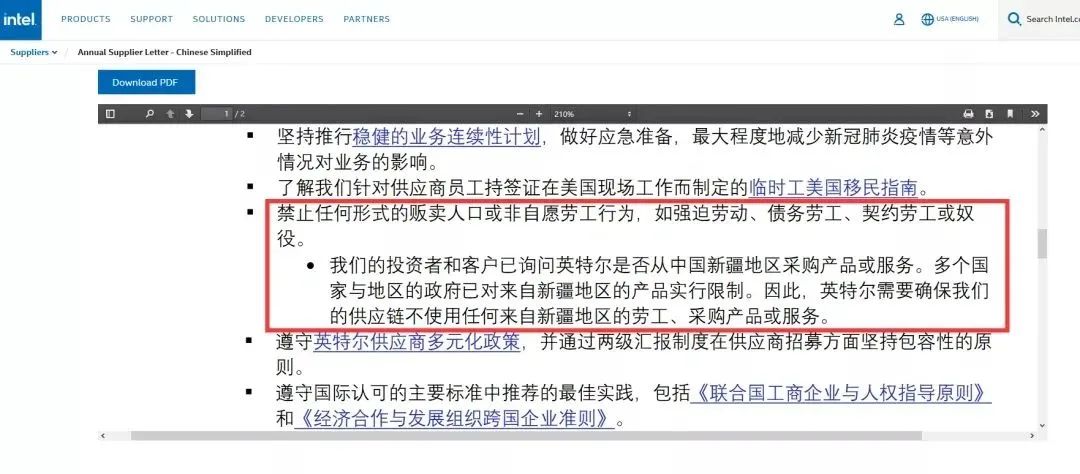

I will not elaborate on the details of the incident here, as major media outlets have already rushed to report on it. It is likely that Intel has released a statement on its official website regarding its suppliers, Our investors and clients have inquired about whether Intel purchases products or services from Xinjiang, China. Several governments in various countries and regions have imposed restrictions on products from Xinjiang. Therefore, Intel needs to ensure that our supply chain does not use any labor, purchased products or services from Xinjiang

Similar incidents have occurred more than once to large multinational corporations in Western countries, such as certain clothing brands that were criticized for deleting statements and boycotted recently.

And this time Intel’s stance is entirely based on the lessons learned from the past, and although the Chinese market is Intel’s world’s largest market, it still has confidence and can be said to be extremely arrogant.

Why does Intel dare to stand out at such a sensitive moment? The answer is, of course, a head iron, not afraid of being beaten, or knowing that no one can beat it.

According to the latest data released by Omdia, the authoritative semiconductor market research department in the UK, Intel ranked second globally in the total sales of semiconductor companies in the third quarter of 2021, second only to Samsung, and its chips sold accounted for 12.3% of the global market, The influence in the semiconductor field is evident (Omdia’s comprehensive ranking does not include semiconductor foundry sales, so semiconductor foundry giants such as TSMC did not appear on the list).

The reason why Intel holds such a large share of the global chip market is well-known: Intel mainly sells the most core chip in computers – the CPU, which is the central processing unit. Specifically, taking the first quarter of 2021 as an example, more than half of Intel’s revenue comes from personal computer CPUs (such as laptops, desktop computers, etc.), and nearly half comes from data center server CPUs. The total revenue of the two is basically 100%, and other sources of income can be ignored.

Let’s take a look at the global market share of Intel’s two major businesses. In 2020, Intel had a market share of 81% in the laptop CPU market and 80.7% in the desktop CPU market, both monopolizing the entire market. The remaining share was also largely occupied by another American company, AMD.

And in the server CPU market, Intel’s share is even more terrifying. In 2020, 94% of global server CPUs used Intel chips, and the remaining small share was still held by its old rival AMD (starting at 91% in the bar chart below, don’t be misled).

The reason why Intel dominates the CPU market and AMD eats leftover food is mainly because the global computer server CPU industry chain is currently built around a chip infrastructure called x86.

The patent owner of x86 architecture is Intel. Due to a series of unclear historical reasons and chaotic lawsuits, AMD is one of the two companies globally authorized by Intel x86 (the other being the now unknown Weisheng), and still survives the competition with Intel, retaining a certain market share.

Unlike ARM companies that specialize in ARM chip architectures, whose main source of revenue is selling ARM architectures to major chip manufacturers, Intel itself makes CPU chips, so it hardly sells x86 architectures to any other competitors.

So, this creates a situation where almost only two companies globally have the strength and ability to produce high-performance CPU chips. If a third company wants to intervene, buying x86 from Intel is basically not feasible (but it can be obtained from the other two, as will be discussed later). Unless this company uses a completely new chip architecture to design CPUs, the key is to make the global computer industry chain acceptable. This possibility is as difficult as if a company were to come forward and design a new operating system to replace Windows and have global software developers redevelop software for it.

Or simply put, the global computer industry has been built on Intel’s x86 foundation for so many years, and it goes without saying how difficult it is to rebuild the industry chain by reopening the market.

Therefore, Intel naturally knows its position, and it is almost impossible for China or any other country in the world (except the United States) to stand up and boycott Intel, which is much more difficult than boycotting a clothing brand.

If you choose to join the AMD camp, on the one hand, Intel chips are irreplaceable in many niche areas, and on the other hand, AMD has also issued an unnamed statement, which means that people have a clear understanding of what they want to do, but I don’t understand.

Is there really no one in China that can compete in the CPU field?

Although there are no high-performance CPU manufacturers like Intel and AMD in China, they are currently in a stage of widespread fire.

There are three main types of enterprises in China that involve CPU research and development. The first type is the easy mode: directly using the x86 architecture. As mentioned earlier, Intel x86 is not sold, but there are two companies in China that have miraculously obtained x86 authorization through various detours, namely Megachip, which obtained authorization from Weisheng, and Haiguang, which obtained authorization from AMD. Although the starting point for CPU research and development using x86 architecture is high, due to the use of pure American technology, the core technology is basically not in one’s own hands, and the risks are extremely high, which everyone understands.

The second type is the ordinary mode: using ARM architecture in the mobile CPU monopoly market to engage in computer and server CPUs, represented by Huawei. The advantage of doing so is that the ARM architecture can be fully authorized (after all, they sell this) and developed freely. The disadvantage is that ARM is not very suitable for the non mobile device market, and ARM also has the risk of being cut off.

The third type is the difficult mode: completely using self-developed chip architecture, pushing down the foundation and starting over again. The representative enterprise is Longxin, which is about to be listed on the Science and Technology Innovation Board. Due to a series of intellectual property lawsuits in the early stages, Longxin has made up its mind to fully switch to the research and development of CPU products based on its self-developed chip architecture LongArch since 2021, and has successfully developed multiple CPU products based on LongArch.

Therefore, although Longxin has taken the most difficult path, it is a difficult yet relatively safe one.

However, even though Longxin has its own intellectual property chip architecture, it is still a pure chip design company, which, like Huawei Hiss, still faces bottlenecks in the field of chip manufacturing.

In addition, Longxin also faces the issue of industry chain support, as no major computer or server manufacturer dares to use a new architecture CPU as its core. Moreover, its performance still lags far behind that of Intel and AMD, and it cannot support mainstream operating systems and software.

However, in the current complex situation, no matter how difficult it is, it is necessary to engage in self research.

A few years ago, there was a serious diplomatic conflict between Japan and South Korea, causing tension between the two sides. However, after Japan directly cut off the supply of various high-end semiconductor materials to South Korea, South Korea immediately softened and the United States intervened. And when technology companies like Intel stand up and clamor one by one, China also needs technology companies that can help the country fight back, and these technology companies that can face tough challenges will inevitably go through a difficult growth process. After all, key core technologies are hard to come by, hard to buy, and hard to win, which has become a path that Chinese technology companies must take in the current situation.