With major central banks such as the Federal Reserve raising interest rates sharply, international geopolitical risks continue to rise, and the risk of economic recession facing the world is also deepening. In this context, the global chip market has cooled rapidly, and its cooling rate is expected to exceed previous expectations.

Authoritative institutions downgrade their forecast for market growth this year

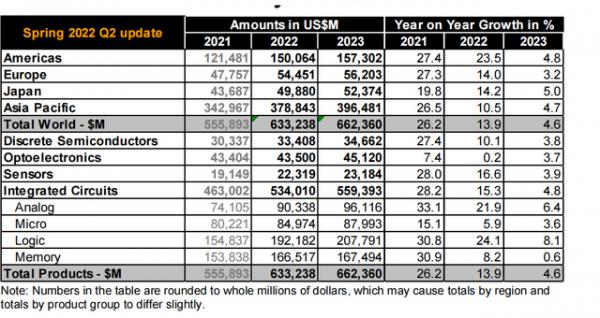

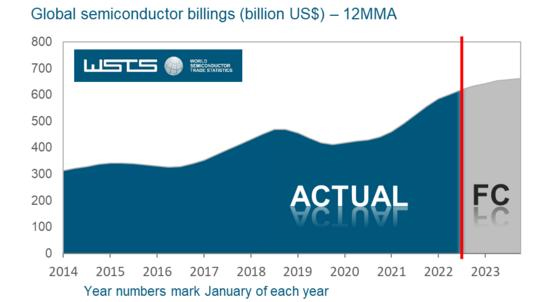

On Monday, Eastern Time, in its latest report, the World Semiconductor Trade Statistics Organization (WSTS) lowered its forecast for chip sales growth this year to 13.9% from the previous 16.3%, and expects chip sales to increase by only 4.6% in 2023, which is 2019. lowest growth rate since. In contrast, the global semiconductor chip sales growth rate in 2021 will be as high as 26.2%. display screen tft

WSTS, headquartered in California, USA, is a non-profit organization that tracks global chip shipments. Its members include Texas Instruments, Samsung Electronics, Sony Semiconductor Solutions, and many other semiconductor industry giants.

WSTS estimates that the size of the chip market this year is US$633 billion, and most categories of chip demand are still expected to show a high year-on-year growth rate. Among them, logic chips are expected to have the strongest growth rate at 24.1%, analog chips are up 21.9% year-on-year, and sensors are up 16.6% year-on-year. Optoelectronic chips are expected to remain the slowest growing category, with a year-on-year growth rate of only 0.2%.

Recession risks drag on chip sales growth

As households and businesses increasingly rely on digital devices and online services, chip sales data has become an important indicator of global economic activity.

The International Monetary Fund (IMF) had already cut its global growth forecast last month, and said global growth in 2023 could be slower than this year.

Bloomberg’s economic model projects a 100% chance of a recession in the U.S. within the next 24 months.

As the risk of economic recession continues to intensify, WSTS expects that the growth rate of the global semiconductor market is expected to drop to 4.6% in 2023, with a market size of US$662 billion. Among them, the market size of logic chip products is expected to reach US$200 billion in 2023, accounting for about 30% of the total market.

WSTS predicts that Japan’s chip sales growth in 2023 may be the strongest, at 5%; followed by the Americas, at 4.8%; Asia-Pacific (excluding Japan) chip sales growth is expected to be 4.7%. The expected growth rate of chip sales in Europe is relatively low at 3.2%, mainly because the Russian-Ukrainian war and related sanctions have dragged down the economic growth of the European continent.